Dr. King’s quest for economic justice continues

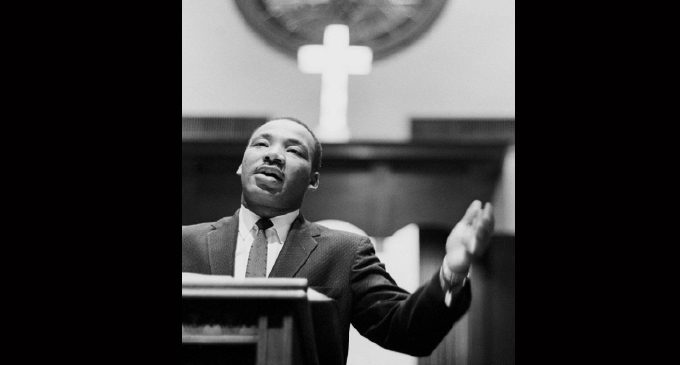

Dr. King delivering his speech, “The Other America,” on March 14, 1968.

By Charlene Crowell

On Jan. 16 the nation will mark its 37th national holiday honoring the life of Rev. Dr. Martin Luther King, Jr. (1929-1968). Across the country observances will chronicle how one man’s efforts pricked the moral conscience of the nation in a lifespan of only 39 years.

When he was just 26 years old and a new pastor at Montgomery’s Dexter Avenue Baptist Church, Dr, King was chosen by community leaders to lead the effort to desegregate the city’s buses following the arrest of Rosa Parks, who refused to give up her seat to a white man.

From December 1955 and continuing for 13 months, an estimated 50,000 Black residents of Montgomery chose to walk, carpool, or patronize Black cab drivers. In the end, the boycott brought economic devastation and a U.S. Supreme Court ruling that the city’s segregation policies violated the Constitution’s 14th Amendment that guaranteed equal protection under the law.

The 2023 observance is also a time to recall how it took 32 years to create the first national holiday to honor a Black person. Although the federal holiday was enacted in 1983, its first observance came three years later in 1986, and at the time only 17 states observed its commemoration. It wasn’t until 2000 that all 50 states observed the King holiday.

Dr. King’s lifelong quest for economic justice is consistent throughout his sermons, speeches, and other writings.

On March 14, 1968, weeks before his assassination, Dr. King gave a speech entitled The Other America. In it, he describes how our nation actually reflected two vastly different experiences. In one, “millions of people have the milk of prosperity and the honey of equality flowing before them … In this America children grow up in the sunlight of opportunity,” noted Dr. King.

“But there is another America,” continued Dr. King. “This other America has a daily ugliness about it that transforms the buoyancy of hope into the fatigue of despair … Probably the most critical problem in the other America is the economic problem. There are so many other people in the other America who can never make ends meet because their incomes are far too low, if they have incomes, and their jobs are so devoid of quality.”

Today the unfortunate reality for much of Black America is that we continue to toil and suffer from that same economic “fatigue of despair.”

As a people, we fervently believe in the value of higher education; but meager financial resources force our students to incur six and sometimes seven figures of debt. Despite laws that call for equal credit, our access to affordable credit is often limited and instead Black Americans are plagued by predatory lending that leaves us with high-cost debts.

In the aftermath of the foreclosure crisis that disproportionately harmed Blacks and other people of color, Congress created the Consumer Financial Protection Bureau (CFPB) to be a financial cop-on-the-beat.

Since opening its doors in 2011, the CFPB has received more than 3.3 million consumer complaints, and delivered over $14.9 billion in monetary compensation, principal reductions, canceled debts, and other consumer relief through its enforcement and supervisory work. Nearly three in four complaints filed –73% – were about credit or consumer reporting. The remainder of the complaints reported issues with debt collection, credit cards and checking/savings accounts and mortgages.

Even so, the quest for financial justice continues. Laws and regulations must be vigorously enforced. But just as with civil rights legislation, the naysayers remain aggressive.

Over the past year, CFPB’s research and surveys have documented how consumers remain at risk via emerging consumer issues such as the Buy Now, Pay Later (BNPL) industry, elder financial exploitation, nursing home debt collection, college banking, student loans, and medical debt on credit reports and payments.

Testifying before the House Financial Services Committee (HFSC) on Dec. 14, CFPB Director Rohit Chopra warned lawmakers of the growing dangers of BNPL.

“The CFPB’s recent study on Buy Now, Pay Later noted a significant increase in use of these products to fund essential goods and services,” said Chopra. “The CFPB is working to ensure that Buy Now, Pay Later lenders adhere to the same protocols and protections as other similar financial products to avoid regulatory arbitrage and to ensure a consistent level of consumer protection.”

Weeks earlier on Nov. 2, the potential harms of BNPL were the topic on the HFSC’s Task Force Financial Technology. Marisabel Torres, speaking on behalf of the Center for Responsible Lending said, “When the borrower’s BNPL loan is linked to a bank account that lacks sufficient funds for payment, the BNPL lender’s payment attempts will typically trigger highly punitive non-sufficient funds (NSF) and/or overdraft fees. … These fees in turn are highly associated with closed bank accounts and exclusion from the financial system. Or, the borrower may have sufficient funds for the BNPL payment but then be left without sufficient funds for other essential living expenses or debts. And many BNPL providers charge their own late or returned payment fees on top of the fees charged by banks.”

For these economic and equality issues, Dr. King’s own words continue to challenge America to live up to its creed:

“Expediency asks the question: is it politics? Vanity asks the question: is it popular? The conscience asks the question: is it right? And there comes a time when one must take a position that is neither safe nor politics nor popular, but he must do it because conscience tells him it is right.”

Amen, Dr. King.

Charlene Crowell is a senior fellow with the Center for Responsible Lending. She can be reached at charlene.crowell@responsiblelending.org.