Editorial: New proposed community bank seeks to engage minority investors

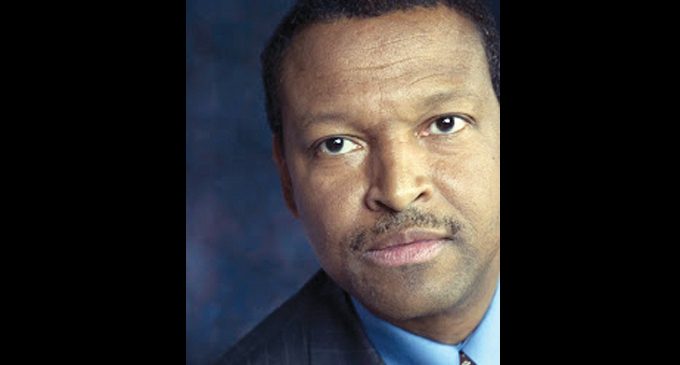

Simpson

By Algenon Cash

Simpson “Skip” Brown is well known throughout Winston-Salem – he is one of Wake Forest’s best all-time

basketball players, a former banking executive with Bank of America and the founder of TriStone Community Bank.

The Boston Celtics drafted Skip after graduation, but he eventually failed to make the team’s final roster. Afterward, he would dedicate his life to a long career in banking.

Skip’s fingerprints are all over the community. He has served on numerous boards, including the Chamber of Commerce, Winston-Salem Foundation, Big Brothers Big Sisters, Second Harvest Food Bank, Boy Scouts, Winston-Salem Business Inc. and the North Carolina Bankers Association.

Not to mention he was largely responsible for helping to launch the Micro Enterprise Loan Program and worked to provide financing for the development of Eastway Plaza in East Winston-Salem – where Food Lion is still located today.

I’ve personally known Skip for nearly a decade. Shortly after he organized TriStone Community Bank in 2004, a mutual friend told me about the well-accomplished banker, and then encouraged me to cold call him. I’ve made thousands of calls during my career, but none would be nearly as powerful as the connection that I made when Skip picked up the phone.

Skip suggested that we have breakfast at Midtown Café, a popular restaurant for local business leaders. Not only did we hit it off immediately, but our relationship blossomed into countless breakfast meetings over the past 10 years. Skip quickly grew into a highly treasured mentor and overall friend. He has provided critical advice and guidance as I’ve sought to develop my investment banking practice and secure important relationships.

Not long after Skip launched TriStone, the national economy experienced a deep credit crisis, which led to the “Great Recession” and harmed a multitude of small financial institutions. Skip made the decision to sell TriStone to First Community Bank for $10 million in 2009. After the acquisition was complete, he became Regional President.

In 2013, Skip retired from banking, and then accepted a position with his alma mater, Wake Forest University. He was hired as assistant athletic director for student-athlete development and operations finance.

Since the recession ended, there has been mass consolidation in the banking industry. Some deals were triggered because smaller banks have found it difficult to compete in the current regulatory environment while others were in a distressed state and needed to be recapitalized. The industry consolidation has left fewer options for consumers and businesses that often require innovative treasury management services, loans and depository vehicles.

Skip quickly recognized the opportunity to fill a vacancy in the market left open by a long list of community banks that have disappeared – Southern Community Bank, High Point Bank, Carolina Bank, Yadkin Bank, New Bridge Bank, Bank of the Carolinas and Bank of North Carolina – all have been acquired by larger out of state financial institutions.

So naturally I was thrilled when Skip contacted me about his intent to start a new community bank that would be located in Winston-Salem. Community Bank of the Carolinas will be the only full service community bank headquartered in Forsyth County. But I was even more excited when he asked me to lead the charge to engage minority investors.

Most often minority professionals, entrepreneurs and business owners are not aware of leading investment opportunities before they reach the mainstream – or at other times may not have the discretionary capital to meet the required minimum investment amount, which can often range between $10,000 and $25,000. But we have developed a pathway that will open the opportunity to smaller investors, lower the barrier to entry and ultimately diversify the base of shareholders that own the new bank.

But the vision is even larger – we hope to introduce new ways for minority owned companies to obtain financing – so we are considering micro lending as way to support this key demographic.

“We are excited to bring a community bank with a strong banking business model emphasizing service to customers and local decision making to Winston-Salem,” Brown said. “We believe those customers who desire a personalized banking experience are being underserved by larger banks in our area.”

Algenon Cash is a nationally recognized speaker and the managing director of Wharton Gladden & Company, an investment banking firm. Reach him at acash@algenoncash.com