Board says it can’t change reappraisal process despite city request

The Forsyth County Board of Equalization and Review (BER) responded to the City Council’s request to review the real estate reappraisal process by saying it doesn’t have the power to change methodology, but does hope to hear appeals on individual properties with issues.

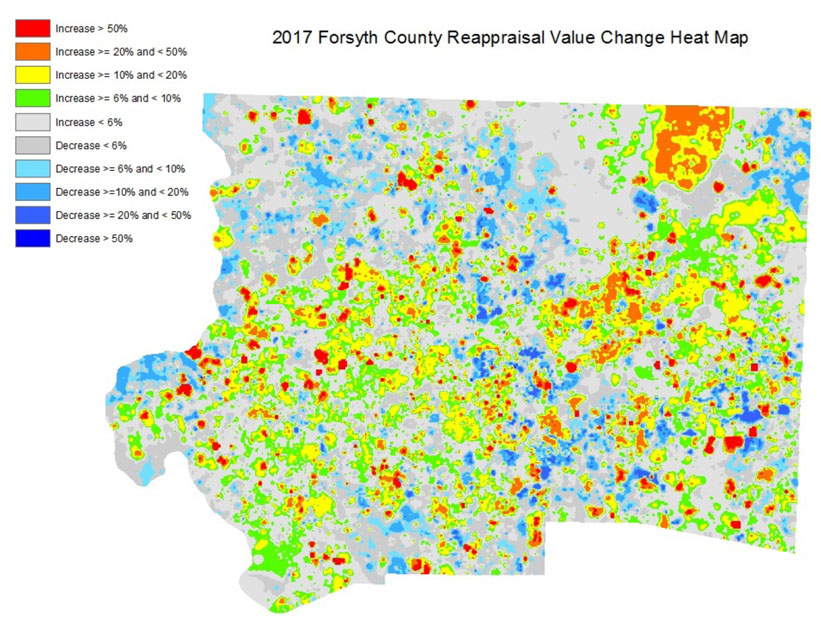

On May 1, the council unanimously passed a resolution asking the BER for an evaluation of the reappraisal process because of what it said was an “inordinate number of properties” in African- American communities that have seen drops similar to the 2013 reappraisal, when 90 percent of properties in the county lost value due to the housing downturn. The council acknowledged it was a small amount of properties with this issue, since 70 percent of properties in the county saw some increase and 62 properties were within 10 percent of previous value.

The BER is a citizen committee appointed by Forsyth County commissioners that hears formal appeals to the reappraisal process and has the power to change the value of any property in the county. The BER heard from Assistant County Attorney Gordon Watkins about the city’s request, during its May 11 meeting. Watkins said that the board has the power to change property values but not the process used to arrive at those estimates.

Watkins said the county follows state statute on the reappraisal process. The methodology is called the Schedule of Values (SOV), which was adopted by the county commissioners last year on Oct. 24 and advertised on Oct. 25, after which there were 30 days for the public to appeal it.

“This board has no authority to override the Board of Commissioners,” said Watkins.

City Attorney Angela Carmon told the BER during the meeting that she “respectfully disagreed” and that the city isn’t appealing the SOV but asking for a review of abnormalities in the process.

“There just seems to be, in certain spectrums of the African-American community, certain things are occurring that may not be occurring elsewhere that should perhaps necessitate an adjustment to the process,” said Carmon.

The BER concurred with the county lawyer on the limits it’s power, but had County Tax Accessor John Burgiss go over the reappraisal process and then, in its May 18 meeting, heard an overview of two neighborhoods Carmon said had reappraisal issues. While they took no action, BER Chairman Richard N. Davis said he hoped to receive appeals on individual properties if the owner believes the appraised value is inaccurate.

“We’re not closing the door on anyone, but we do need specific information,” he said.

Appeals are actually down this year. Informal appeals to the tax office are at a 20-year low with 3,072 appeals, which represents 1.93 percent of county property values. Formal appeals to the BER can be made until June 30, but there were only 468 as of May 18. Burgiss said that in 14 market areas in East Winston and the four in the Waughtown area he examined, there were only 79 informal appeals, which is 1.52 percent of the property values in those areas and include many appeals asking for values to be lowered.

During a presentation on May 18, Nolan Lawson, a senior county tax manager, responded to the city’s suggestions. On the suggestion to go door-to-door in older black communities, Lawson said they don’t have enough staff for massive door-to-door efforts, and on the market areas they have done that in, it yielded little that changed the values. They do regularly go out to examine the interiors of homes for those who appeal. On the suggestion of determining value by including rental income that the owner receives from a property, it was uncertain if that would change the value much or even make the value higher.

On the two neighborhoods Carmon mentioned with reappraisal issues, which were Castle Heights and Dreamland, Lawson concurred those markets were depressed, which meant most sales were disqualified during reappraisalas not reflecting the true property value such as distressed sales or sales between two financial institutions. In Castle Heights, there were only 18 qualified sales in four years. Lawson said the homes in these neighborhoods lacked the square footage, amenities and access to goods and services within walking distance that has become popular in the housing market.

The Ministers’ Conference of Winston-Salem and Vicinity also says black communities are negatively affected by reappraisals and have sent a letter to the U.S. Department of Housing and Urban Development and the Winston-Salem Human Relations Department with their concerns.

Carmon said she’s waiting to hear back from City Council members if there are other neighborhoods they’d like the BER to review. She has received a request for tax staff to come out and do community information sessions on appeals, which she’s forwarded to the county.