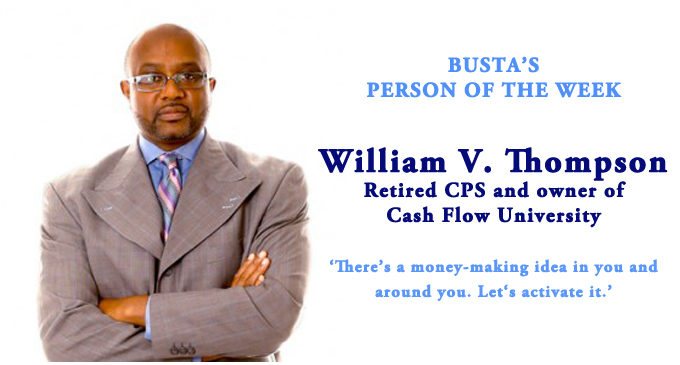

Busta’s Person of the Week: ‘There’s a money-making idea in you and around you. Let’s activate it.’

By Busta Brown

I’m going to begin this article by asking you to read 2 Kings 4:1-7 after you’ve read about my Person of the Week. His theory that “money is nothing but an idea” is based on that scripture.

“Zoom was in somebody’s head one day. It materialized and now the guy is a multi-millionaire. Anything that we’re sitting on, touching, seeing, hearing, was somebody’s idea one day. The best thing that was created in life has still yet to be created. Just like the story of the widow’s olive oil in 2 Kings 4:1-7. If people could simply look around them and let some of those ideas materialize, that’s how you create money,” said William V. Thompson. William is the owner of Cash Flow University and a retired CPA. His company gives people an informal education so they can solve their financial problems and learn how to create money, based on what they have to fund and fulfill their dreams.

With millions of Americans unemployed, I asked William about the changes with the unemployment benefits. “With the C.A.R.E.S Act, people are able to get their regular unemployment plus they’re able to get an extra $600 per week, regardless of what you made. Plus, people that are self-employed who never paid into the unemployment system, they can draw. Business owners can draw as well. Now a whole class of people that didn’t qualify, now qualify. Some people are making more money collecting unemployment than on their jobs,” he said.

I asked William, when should those employees go back to work? “I’m not an attorney so I can’t give legal advice. But I spoke with the people at the North Carolina Employment Commission and they said if your employer tells you your job is open and they’ve provided you a safe environment, you have to come back or else their unemployment benefits can be cut off,” explained Thompson.

I asked the retired CPA, if I can’t pay my bills like car loan, utilities, and student loans, what should I do? “This is a law! If you have a federal student loan, they’ve given you an automatic deferral through September 30, so you don’t have to pay any fees or interest between now and September 30. Everything else is by vender relationship, so reach out to your lender and let them know you’ve been laid off and can’t pay your car note. They’re not required by law to do it, but they’ve been encouraged by the Trump Administration to give people three to six months deferred, and 99% of my clients have got the deferrals. And it works the same way with utilities. So make the calls now, don’t wait because they will work with you”.

William has a few suggestions for businesses that aren’t generating revenue. “File for unemployment right now. Don’t wait! Secondly, I recommend that you apply for some of those SBA loans. The micro-lender’s terms are more flexible. Also, look at your spending plan and ask yourself, is there anything you can reduce or eliminate? Call your lenders as well, to work with them on lowering your payments. You can go from paying $4,000 a month in bills, to $2,800 a month. Thirdly, look to see how you can monetize your business legally online or through social media. I have a client that’s a hairstylist and she makes almost more money teaching online courses, and had never done that before. Some of my restaurant clients are moving out of their restaurants and making money doing food trucks. Find ways to monetize your business even with the doors being closed,” William shared.

There are still a lot of us who are blessed to be gainfully employed and are confused on what to do with our 401(k) and IRA. Also, some laws have changed as well. So I asked William to navigate us through this. “It used to be that you could only borrow about $500 on your 401(k). Now, they’ve doubled it and you can borrow up to $1,000. And if you had a loan that was due to be paid off this year, you don’t have to pay it this year due to COVID-19. You can now borrow money from your IRA account and they will waive the 10% penalties, let you pay it back over three years, or let you pay the taxes on it over three years. They’re doing a lot of incredible things to allow people to have access to their money to minimize the tax liability.”

I asked if we should continue paying into our 401)k). “Yes! I tell you why. Before you do so, make sure you can pay your bills. And assuming you can pay your bills and still pay into your 401(k), if you’re paying $300 a month into your 401(k) and your company is matching it. I want you to continue getting that free $300 a month, but only if you can afford it. Secondly, stock that was once $100 a share is now down to $60 a share. So you’ll able to buy more of a good stock while it’s down. And thirdly, the tax benefits, so do all you can to continue to contribute to your 401(k),” said Thompson.

If you’re struggling with bad credit, he also shared great sources where you can borrow money. “You can borrow from your 401(k) and they don’t check your credit. Number two, you can borrow from your insurance policy that has cash value in it and they don’t check your credit. Thirdly, you can borrow from the IRS. Get with a tax professional and get something called a six month interest-free IRS Loan. Your tax professional can show you how to legally structure your withholdings, as long as you pay it back by December 31. 2020. You can also borrow from your IRA account, as long as you pay it back in 60 days,” William shared.

The financial guru encourages those of us who are struggling financially to get together with our friends on Zoom, to create a financial empowerment team. “Learn to build our credit together, how to save money together, and how to start an online business together. So instead of wasting time with our friends, invest that time building ways to create money.” That’s some solid advice.

My Busta Brown Person of the Week is William V. Thompson. If you’d like to contact William, call 336- 272-7373 or visit CashflowU.org. “It’s all about empowering people economically through education.”